Consolidation

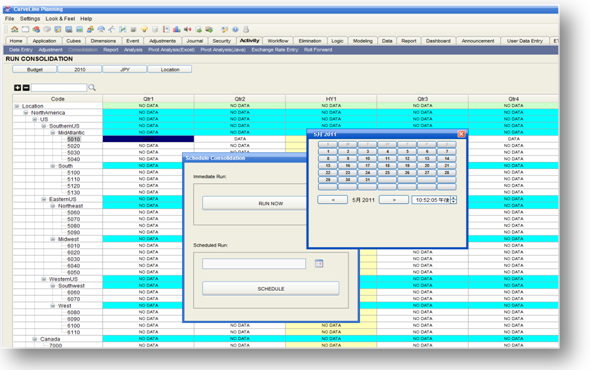

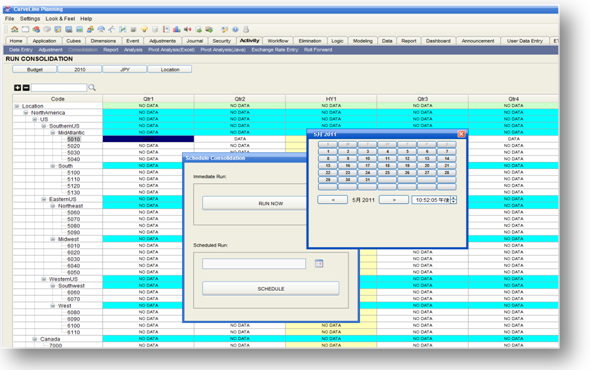

Consolidation is a process of gathering and aggregating data from child to parent entities. Data is loaded into the child

entities and through Curveline consolidation engine data will be aggregated through the organization. The conslidation engine will

simultaneously perform currency transalation and intercompanny elimination on the data. Consolidation can be launched has a batch

process using the curveline batch engine. Consolidation can run for a single period or for multiple periods and rollups.

When the consolidation starts the following process is executed:

. User defined logic will run based on input and adjustment data in the input currency

. The data is translated to the destination currency

. The parent adjustments entered in the destination currency will be aggregated

. Automatic intercompany elimination process will be run

Curveline planning can also handle the IFRS consildation with its flexible architecture. Data can be easily transformed between various GAAPs.

End user with excel skills can easily build and update the IFRS rules ensuring no additional costs for IT and minimal involvement of IFRS consultants.

International Financial Reporting Standards (IFRS) is a set of accounting standards, developed by the International Accounting

Standards Board (IASB) that is becoming the global standard for the preparation of public company financial statements.

International Financial Reporting Standards remove some of the subjectivity from financial reporting and provide a consistent

basis for recognition, measurement, presentation and disclosure of transactions and events in financial statements. In recent

past, there have been cases where companies reporting under IFRS in Europe record a loss but when these same companies re-state

their accounts according to US GAAP they record a profit.

Convergence of accounting standards will have the effect of attracting investment through greater transparency and a

lower cost of capital for potential investors. In recent times Companies are finding it increasingly difficult to raise

money and get them listed on stock exchanges as they were not following the standard in accordance with IFRS. Differences

in accounting practice make it difficult for investors, whether individual or institutional, to compare the financial

results of different companies and make investment decisions.

1. Curveline's sophisticated consolidation engine does automated inter-unit elimination and calculation

of accounting adjustments such as minority interest and equity investments

2. Curveline planning interface allows the users to define complex and changing group ownership structures, including consolidation of sub-groups and use

of multiple accounting methods

3. Full audit trail of accounting adjustments and journal posting functionality

4. Integration of SAP and non-SAP ledger data

5. Flexible foreign currency translations capable of handling multi-currency groups

Click for price details

Click to contact for more details

Click for brochure |