InterCompany Elimination

Consolidated financial statements are required when there are two or more affiliated companies. When a parent company

either directly or indirectly controls a majority interest of a subsidiary, consolidated financial statements must be

presented. Consolidated financial statements present the results of operations, statement of cash flows, and financial

position of the combined entity. Separate accounting records are kept for each separate company, but not for the

consolidated entity. To determine the consolidated amounts, the amounts for the individual affiliated companies are

added together. Elimination entries are made to remove the effects of inter-company transactions.

When one company acquires another company, a consolidated balance sheet needs to be prepared. The first step is to

eliminate the effects of any inter-company transactions. There are three basic types of inter-company eliminations

. The first type is the elimination of inter-company stock ownership. This entry eliminates both the asset and the

stockholders’ equity accounts for the parent company’s ownership of the subsidiary.

The second type of inter-company elimination is the elimination of inter-company debt. When the parent company makes

a loan to a subsidiary, the parent company would have a note receivable and the subsidiary a note payable. When the

two companies are consolidated, or combined, the loan is just a transfer of cash, so both the note receivable and

note payable are eliminated.

The third type of inter-company elimination is the elimination of inter-company revenue and expenses. These inter-company

revenues and expenses are eliminated since they are really just transfers of assets from one affiliated company to another

and have no effect on consolidated net assets. Some examples of inter-company revenues and expenses are sales to affiliated

companies, cost of goods sold as a result of sales to affiliated companies, interest expense or revenue on loans to or

from affiliated companies, and rent or other revenue received or paid for services either rendered to or received from

affiliated companies.

An important item to understand in regard to consolidated financial statements is the concept of minority interest.

A minority interest exists when a parent company owns a majority interest in a subsidiary, but not 100% of the

outstanding shares. In this case, the minority interest would be shown on the balance sheet as a type of ownership

equity. The minority interest is the ownership interest in the subsidiary that is held by stockholders other than

the parent company. Since there are minority stockholders, just the amount of the stockholders{f equity that is

owned by the parent company is eliminated.

One of the GAAP guidelines related to consolidated financial statements states that the retained earnings of a

subsidiary company that were created before the date of its acquisition can’t be included in the consolidated

retained earnings of the parent company and its subsidiaries. In addition, any dividends declared from those

retained earnings can’t be included in the parent company’s net income. GAAP also states that comparative

financial statements are preferred for annual reports.

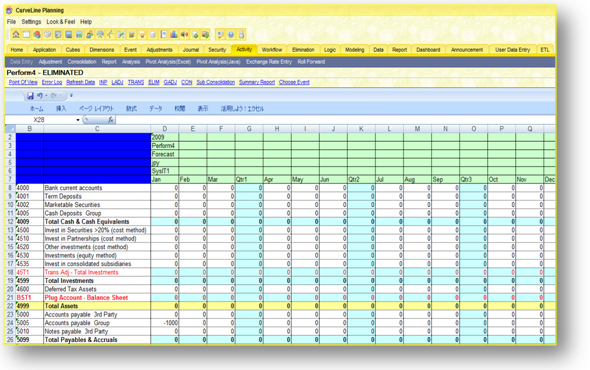

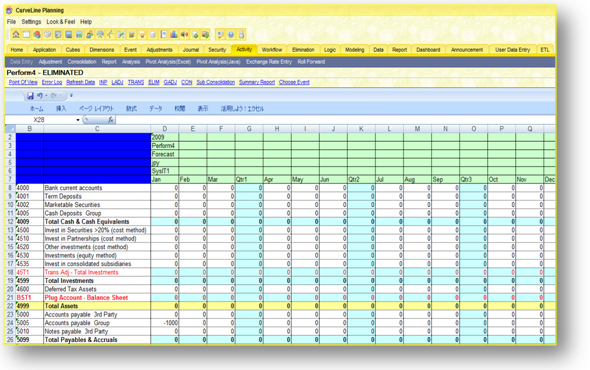

Curveline planning intercompnay elimination as the following features:

1. Different intercompnay elimination groups can be set. Based on the different intercompany elimination group settings

elimination will automatically happen.

2. Elimination will happen at a common parent level.

3. A common elimination entity settings can be used to eliminate all the intercompnay transaction in a common entity

level.

4. Intercompany

If you need help with your consolidated financial statements, audit, income taxes, general accounting, or

other financial reporting, you are in the right place. Please try out the CPA search feature on this website

to find a qualified professional in your area to assist you with all your accounting and tax needs.

Deduction of intercompany items when preparing the combining or consolidated balance sheet and income statement.

Examples are intercompany loans and intercompany investments between the parent and subsidiary. In the case of

extensive eliminations, an eliminations ledger may be used.

Click for price details

Click to contact for more details

Click for brochure

|