Analysis

Financial analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project.

First of all, a business must already have appropriate management reports to quickly identify areas requiring management attention.

Once these issues are identified, it will be necessary to drill-downinto operational aspects that need fixing. There are various

reasons that lower-level management and employees may not be capable or willing to identify and fix problems. Therefore a neutral

finance-based analysis will help identify the problems and their sources, as well as point to ways of improving the problems

Curveline Planning cash flow statement will reveal where the company's resources have come from and how they have been applied

during the year.Ratio analysis is an important tool for understanding and comparing business performance. However, ratios and

other financial calculations are rarely useful when looked at in isolation. it is important to carry out calculations of ratios

and other significant financial figures with previous years (many companies publish five or ten year summaries as part of their

annual reports) in order to identify positive or adverse trends). Comparison with other, relevant competitors and industry "norms"

is also important.

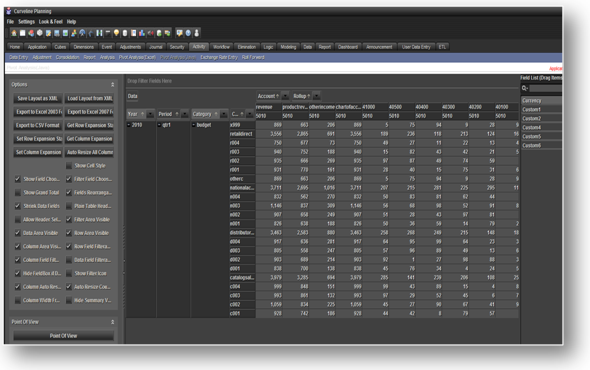

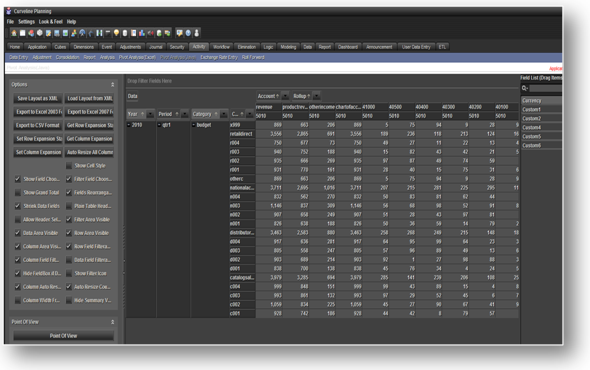

During drilldown, users can instantly pivot financial information online to work through what-if and what-happened scenarios,

rather than writing several custom reports. With the ease of drag and drop a graphical user interface (GUI) capability that

lets you perform operations by moving the cursor. For example, using pivot analysis functionality column headers and row headers can be interchanged

and more detailed drill down is possible with the simple mouse cursor operation. Users can sort accounting

dimensions such as charts of accounts, periods, rollup, versions within a multidimensional view to quickly reorganize

summary and detail financial information. Alternatively, users can compare figures across multiple business units, departments,

or product lines to pinpoint a specific piece of information.

The versatility of the Analysis functionality increases productivity by enabling information users to quickly detect trends and

exceptions in their financial data and simultaneously expand the organization's knowledge of the relationships between

components of financial information.

Click for price details

Click to contact for more details

Click for brochure

|